Introduction

The financial world is transforming at an unprecedented pace, and mobile app development is at the forefront of this digital revolution. With more users shifting to mobile-first solutions for banking, investing, and daily transactions, creating a secure, intuitive, and unique payment app experience is not just a luxury—it’s a necessity. As users seek convenience and personalization, app development companies must evolve beyond conventional templates and focus on innovation.

This blog explores the critical role of mobile app development and web development in building payment solutions that define the future of finance. Whether you’re a startup looking to disrupt the space or an established institution adapting to digital trends, the importance of leveraging expert app development services cannot be overstated.

Why Payment Apps Are the Future of Finance:

Cash is becoming a relic of the past. With increasing smartphone penetration and digital awareness, users prefer to make transactions through payment apps. According to global reports, mobile payment transactions are projected to cross $12 trillion by 2026. This dramatic shift is powered by two things:

1. Digital Accessibility – Users from urban and rural regions can easily access financial services.

2. Speed and Convenience – Payments can be made with a single tap, without standing in queues or handling physical currency.

Hence, creating a robust, scalable, and engaging payment app is not just a business trend—it’s a response to changing user behavior.

The Role of Mobile App Development in Fintech

At the core of any successful payment app is top-tier mobile app development. The process involves more than just coding; it’s about building a seamless bridge between technology and the end-user. Here’s how great app development shapes the payment experience:

- UI/UX Design: A clean, intuitive interface is key. Mobile users demand an experience that’s fast, secure, and easy to navigate.

- Security Protocols: Financial data is sensitive. Biometric authentication, encryption, and two-factor verification are must-haves.

- APIs & Integrations: Seamless integration with banks, wallets, credit cards, and other services enhances functionality.

- Real-Time Updates: Users want to see instant transaction status, updated balances, and notifications.

When executed well, mobile app development turns complex financial operations into user-friendly actions.

Key Features of a Successful Payment App

To craft a unique payment app experience, app development companies must embed a mix of core functionalities and advanced features. Let’s break down the must-haves:

1.User Registration & Verification

Secure KYC (Know Your Customer) procedures ensure legal compliance and safety.

2.Digital Wallet Integration

Allow users to load and store money in-app for seamless payments.

3.Multi-Layered Security

Include end-to-end encryption, secure login options (face ID, fingerprint), and fraud alerts.

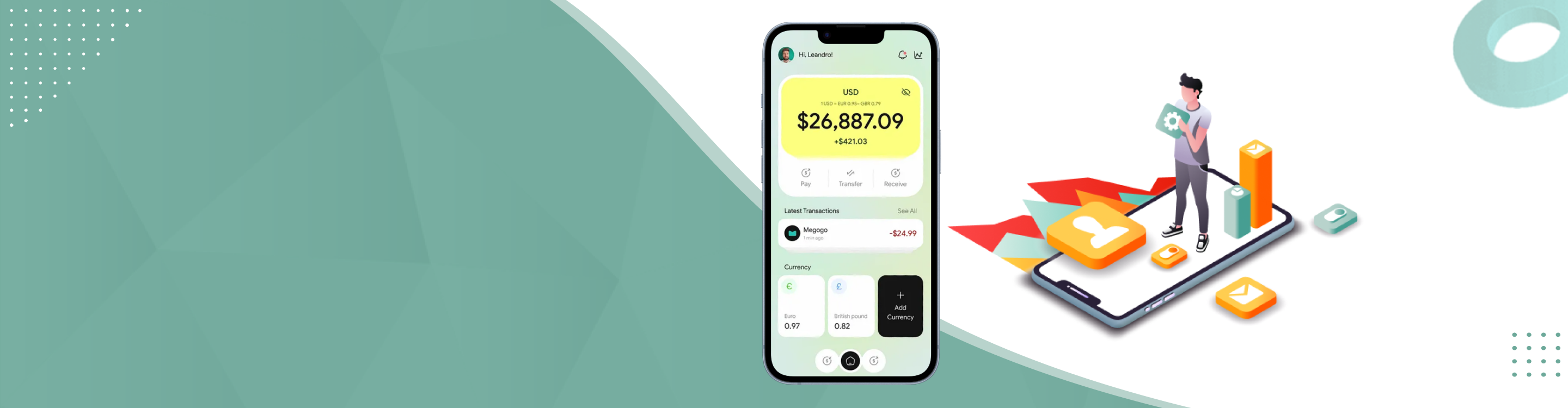

4.Transaction History

A detailed breakdown of transactions helps in transparency and financial tracking.

5.QR Code Scanning & NFC Payments

Instant peer-to-peer transactions via QR or contactless systems enhance ease of use.

6.Multi-Currency & Cross-Border Payments

Enable global transactions for users with international needs.

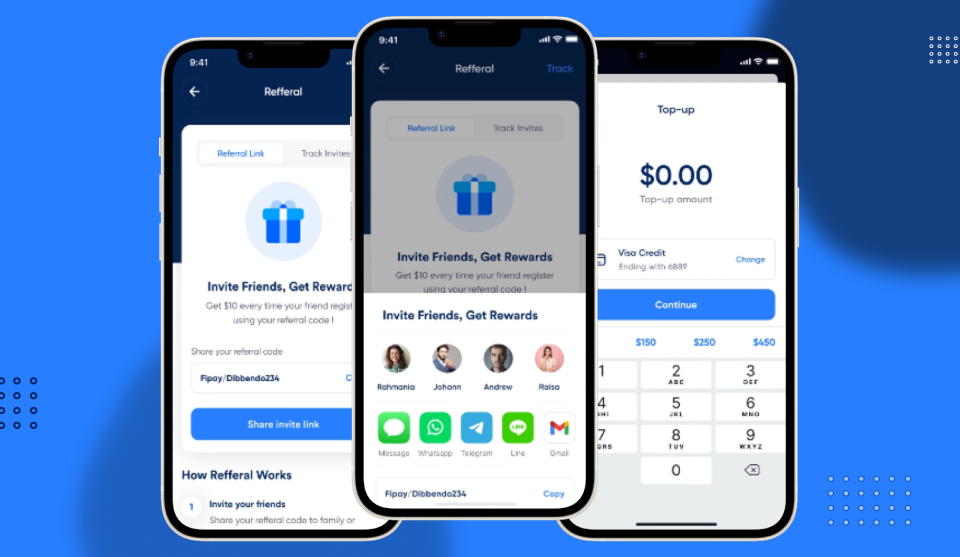

7.Personalization through AI

Show users tailored offers, spending insights, and budgeting tools using AI-powered analytics.

8.Chatbot and Support Integration

Ensure users can reach help quickly through in-app chat support or AI bots.

These features make the app more than just a payment tool—it becomes a financial companion.

The Role of Web Development in Payment Systems

While mobile apps dominate, the importance of web development cannot be ignored. A payment ecosystem should function flawlessly across devices. Many users still prefer using desktops or tablets for larger transactions, bill payments, and account management.

A leading web development company ensures that your web version is as responsive, secure, and visually appealing as your mobile app. With responsive design, web portals can support login, transaction history, bank linking, and customer service functionalities efficiently.

Choosing the Right App Development Company

Your choice of a mobile app development partner can make or break your fintech idea. Here’s what you should look for in an app development company:

- Industry Experience: Fintech has unique regulatory, security, and usability requirements. Choose a company that understands these.

- Cross-Platform Expertise: Whether it’s iOS, Android, or hybrid apps, the development company should build apps that run smoothly across all platforms.

- Security First Approach: Financial apps are targets for cybercrime. Your developers should prioritize security frameworks and compliance (PCI-DSS, GDPR, etc.).

- Agile Development: Finance is fast-moving. Choose a company that uses agile methodologies for quicker rollouts and updates.

- Post-Launch Support: App development doesn’t end at launch. Regular updates, bug fixes, and security patches are essential.

Investing in expert app development services ensures your product stays ahead of the curve and user expectations.

Trends Shaping the Future of Payment Apps

To stay competitive, fintech players must anticipate and adapt to evolving trends. Here’s what the future holds:

1. Blockchain Integration

Decentralized finance (DeFi) and cryptocurrencies are gaining mainstream attention. Blockchain can make transactions more secure, transparent, and efficient.

2. Voice-Enabled Transactions

Voice commands can streamline payments, especially for visually impaired users or for hands-free use.

3. Biometric Authentication

Beyond fingerprints, iris and facial recognition add another layer of user-specific security.

4. Open Banking APIs

Third-party integrations through open banking APIs allow users to manage multiple accounts from a single app.

5. AI-Powered Personal Finance Tools

Smart analytics can help users track spending, receive savings tips, and get loan approvals faster.

6. Sustainable Fintech

Green fintech apps offer carbon tracking and eco-conscious spending insights—appealing to eco-aware consumers.

Being aware of these trends helps app development services stay innovative and user-centric.

Real-World Example: The Rise of UPI in India

India’s financial landscape has been transformed by UPI (Unified Payments Interface). Apps like Google Pay, PhonePe, and Paytm have capitalized on user-friendly design and strong backend infrastructure to revolutionize how millions handle money daily.

The key takeaway? An intuitive user interface backed by a robust technical framework built by expert app development companies can create a digital payment revolution.

Challenges in Developing a Payment App

Developing a unique payment app comes with its share of challenges:

- Regulatory Compliance: Every region has its financial laws and compliance standards.

- Scalability: The backend must handle thousands (or millions) of concurrent transactions.

- Fraud Detection: Detecting suspicious patterns in real-time is critical to minimize losses.

- User Education: New users may need onboarding tutorials to understand features.

Overcoming these challenges requires the combined skills of a mobile app development and web development company.

Final Thoughts

The financial world is moving toward digital-first experiences. In this evolving landscape, payment apps are not just tools—they are the new financial hubs for users. From paying a friend back to managing international funds, mobile applications are revolutionizing how we interact with money.

To truly stand out, businesses must focus on mobile app development that combines functionality with innovation. Partnering with a skilled app development company ensures that your app is future-ready, secure, and built to scale.

Whether you’re building your first MVP or expanding your digital product suite, remember: finance is no longer bound to banks—it’s in your pocket, one tap away.

FAQs on Payment App Development

Q1. Why are payment apps important for the future of finance?

Payment apps offer speed, security, and convenience. With the global digital payments market expected to cross $12 trillion by 2026, businesses must adapt to meet customer expectations for cashless, mobile-first solutions.

Q2. What features should a secure payment app have?

A secure payment app should include multi-layered security (biometric login, encryption, fraud detection), digital wallet integration, transaction history, and real-time notifications.

Q3. How does mobile app development impact fintech?

Mobile app development ensures that financial transactions are seamless, scalable, and user-friendly. From UI/UX design to API integrations and security protocols, it defines how users interact with money digitally.

Q4. Is web development still relevant if mobile apps dominate?

Yes. Many users still prefer desktops or tablets for bill payments, large transactions, and account management. A responsive, secure web portal complements mobile apps to create a complete fintech ecosystem.

Q5. How do I choose the right app development company for fintech?

Look for companies with fintech experience, cross-platform expertise, a security-first approach, agile development methods, and post-launch support. These qualities ensure your app stays compliant, scalable, and future-ready.

Q6. What are the biggest challenges in developing a payment app?

Challenges include regulatory compliance, scalability, fraud detection, and user education. Partnering with an experienced development team helps overcome these hurdles.

Q7. What trends are shaping the future of payment apps?

Key trends include blockchain and cryptocurrency adoption, AI-powered personal finance tools, voice-enabled transactions, open banking APIs, and green fintech solutions.