In today’s mobile-first digital world, banking no longer happens just at a branch—it happens on your smartphone. Whether it’s transferring funds, paying bills, or checking balances, users now expect their entire banking experience through a mobile app. While the convenience of mobile banking is unmatched, it also brings two critical challenges: security and scalability.

At Siddhi Infosoft, we specialize in mobile banking app development for financial institutions and fintech startups. With years of experience, we know that a successful banking app isn’t just about a sleek interface—it must be bulletproof, compliant, and future-ready.

If you’re a CTO, product manager, or startup founder exploring fintech app development services, this guide covers best practices to ensure your mobile banking app is secure, scalable, and user-friendly.

1. Prioritize Security in Mobile Banking App Development

Security is the foundation of every successful banking application. A mobile banking app handles highly sensitive data—account numbers, passwords, and transaction histories. Security must be embedded from day one, not added as an afterthought.

Key security measures include:

- End-to-End Encryption: Make sure all data, whether at rest or in transit, is encrypted using advanced standards like AES-256 and TLS 1.3.

- Biometric Authentication: Fingerprint and facial recognition add an extra layer of protection—and convenience.

- Multi-Factor Authentication (MFA): Always enforce MFA. A password alone is never enough.

- Secure Code Practices: Avoid hardcoded credentials and use secure coding frameworks to prevent vulnerabilities like SQL injection or cross-site scripting.

- Regular Penetration Testing: Work with security experts who test your app against real-world threats.

At Siddhi Infosoft, our mobile app development lifecycle includes rigorous security testing at every stage, from design to deployment.

2. Build for Scalability from the Start

A scalable mobile banking app can handle growing users and evolving features without downtime. Planning for scalability ensures your fintech solution remains fast and reliable as demand increases.

Here’s how we approach it:

- Cloud-Native Architecture: We leverage platforms like AWS, Azure, or Google Cloud to ensure elasticity and easy scaling.

- Microservices over Monoliths: Breaking the app into microservices allows different parts of the system to scale independently.

- Database Optimization: Choosing the right database (like PostgreSQL, MongoDB, or DynamoDB) and optimizing for concurrent reads/writes ensures performance doesn’t suffer as traffic grows.

- Asynchronous Processing: Use background workers for tasks like sending OTPs, generating reports, or processing images to reduce front-end lag.

- Load Testing: Before any big release, simulate thousands of users to make sure your app can handle the heat.

At Siddhi Infosoft, every fintech app we build is architected for growth.

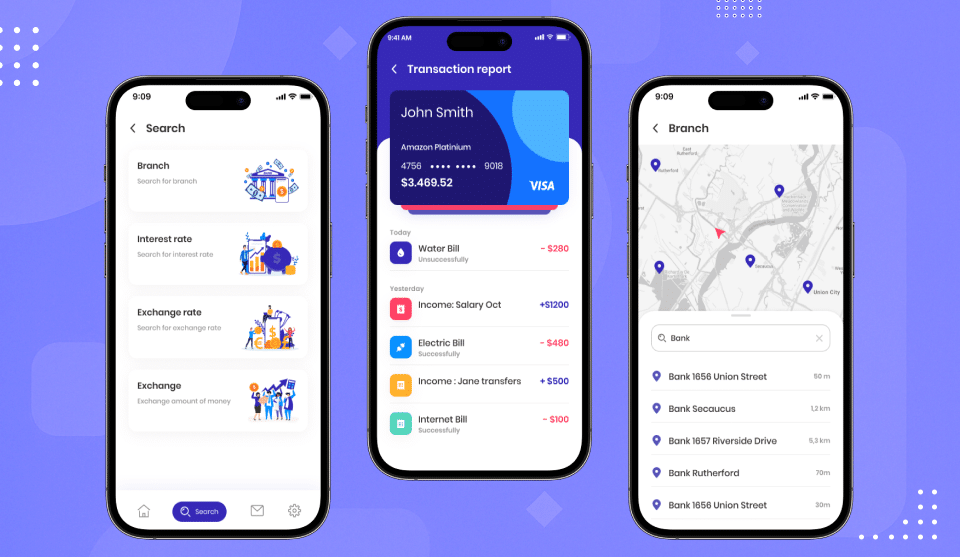

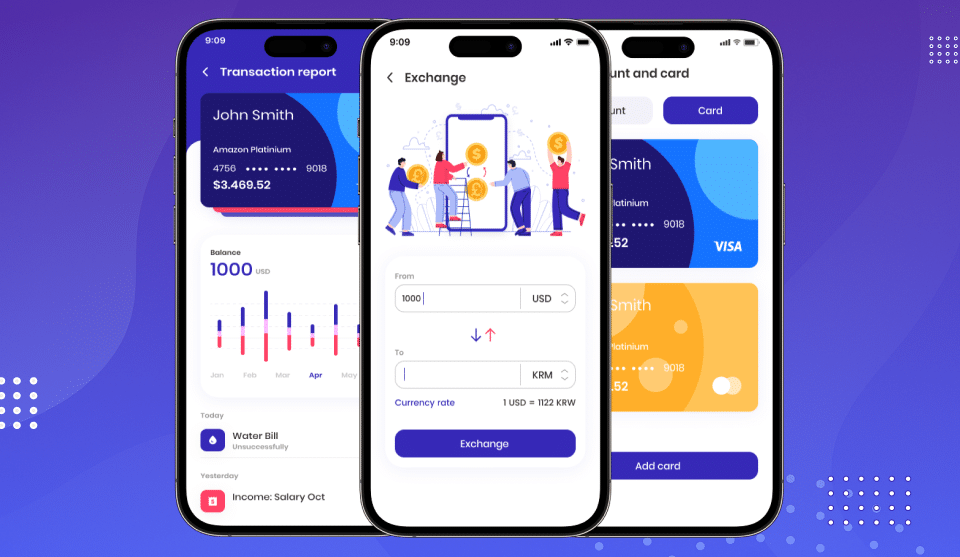

3. Deliver a Seamless User Experience

Even the most secure app won’t succeed without a smooth user experience (UX). Mobile banking apps must be fast, intuitive, and accessible.

UX best practices for banking apps:

- Keep It Simple: Use clean layouts, intuitive icons, and clear instructions.

- Speed Matters: Optimize loading times. Every second counts.

- Accessibility First: Design for people of all ages and abilities. Contrast, font sizes, and screen reader compatibility matter.

- Personalization: Use AI and data to offer custom insights, like spending summaries or savings tips.

- Offline Capabilities: Allow users to view balances or statements even without an internet connection.

As seasoned mobile app developers, we know that the best design is the one users don’t even notice—because it just works.

4. Regulatory Compliance Is Non-Negotiable

The financial industry is heavily regulated, and compliance is non-negotiable. Whether it’s PCI-DSS, GDPR, SOX, or RBI guidelines (for India), your mobile banking app must meet global and regional requirements.

Compliance essentials:

- Conduct regular audits.

- Document your data handling policies.

- Include user consent and opt-in mechanisms.

- Make data deletion and export easy.

- Stay updated with changes in laws across regions.

Partnering with an experienced app development company like Siddhi Infosoft ensures your app ticks all the right legal boxes—saving you from future headaches.

5. Implement Real-Time Monitoring and Analytics

A banking app’s success depends on how it performs in real-world conditions. Real-time analytics help you track performance, identify issues, and enhance user experience.

Essential analytics include:

- User behavior: Understand how people use the app and what features are most used.

- Crash reports: Get immediate alerts when something breaks.

- Transaction success rate: Monitor failed vs. successful transactions.

- Security alerts: Get notified of suspicious login attempts or high-volume transfers.

We integrate robust tools like Firebase, Mixpanel, and New Relic into your mobile banking app so that you’re never flying blind.

6. Secure API Integrations

APIs are the backbone of modern fintech applications, enabling transactions, authentication, and integrations. But unsecured APIs are a major risk.

Best practices for API use:

- Use OAuth 2.0 for authentication.

- Implement rate limiting to prevent abuse.

- Use secure tokens and rotate keys regularly.

- Keep all API traffic encrypted and monitored.

Siddhi Infosoft’s app development services include building and securing RESTful APIs that perform well under pressure.

7. Future-Proof with Modular Development

Banking technology is evolving rapidly—cryptocurrency wallets, voice banking, AI, and 5G are shaping the future. A future-ready banking app must adapt to these innovations.

To keep up with future trends:

- Use modular codebases that make it easy to add new features.

- Containerize apps using tools like Docker and Kubernetes.

- Stay updated on tech like 5G, AI, and blockchain.

- Build with CI/CD pipelines for faster updates and hotfixes.

A future-ready mobile banking app isn’t just about what it does today—it’s about what it can do tomorrow.

8. Choose the Right App Development Partner

Building a secure and scalable banking app requires an experienced partner.

At Siddhi Infosoft, we bring:

- Over a decade of experience in building high-performance apps

- A full-stack team of UI/UX designers, backend engineers, QA testers, and project managers

- A history of delivering solutions for fintech, insurance, and banking companies

- Agile methodology for iterative development and faster time to market

We’re not just another app development company—we’re your strategic tech partner.

Few important FAQs

Q1. What is mobile banking app development?

Mobile banking app development is the process of designing and building secure applications that allow users to perform banking activities—such as checking balances, transferring money, or paying bills—directly from their smartphones.

Q2. How do you ensure security in a mobile banking app?

Security in mobile banking apps is ensured through end-to-end encryption, biometric authentication, multi-factor authentication, secure coding practices, and regular penetration testing. These measures protect sensitive financial data from cyber threats.

Q3. Why is scalability important in banking applications?

Scalability ensures that your fintech app can handle a growing number of users and transactions without compromising speed or performance. It allows banks and startups to expand features and manage traffic spikes smoothly.

Q4. How much does it cost to develop a mobile banking app?

The cost of developing a mobile banking app depends on factors like features, complexity, security requirements, compliance standards, and integrations. A basic app may cost less, while enterprise-level apps with advanced features require higher investment.

Q5. Why choose Siddhi Infosoft for banking app development?

Siddhi Infosoft has 10+ years of experience in fintech and banking app development, offering expertise in security, scalability, compliance, and UX design. Our full-stack team ensures your app is future-ready and regulatory compliant.

Conclusion

A successful mobile banking app is more than just a digital tool—it’s a trustworthy financial platform users rely on daily. To achieve this, security, scalability, UX, compliance, and future-readiness must guide every stage of development.

At Siddhi Infosoft, we help fintech startups, banks, and enterprises build secure, scalable, and future-ready mobile apps.

Ready to transform your banking vision into reality? Connect with our expert mobile app developers today and let’s build a financial app your users can trust.